Proponents say they’ve gathered enough signatures to place 40-year sales tax increase on Sacramento County November ballot

The petitioners – the San Francisco Baykeeper, Restore the Delta, Delta counties and agencies, among others – vigorously opposed DWR’s motion.

While the former president's economic policy had its share of critics, Biden's policies offered businesses and the economy a degree of orthodoxy.

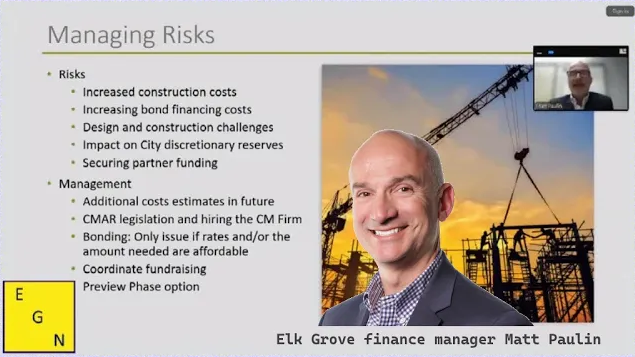

So, if interest rates have dropped, making construction feasible and cheaper, why hasn't the city rushed into issuing the bonds?

“This marks the third year in a row of no commercial fishing allocation in California and the state’s first recreational salmon season since 2022.”